This could make buying a house even less affordable for prospective homebuyers

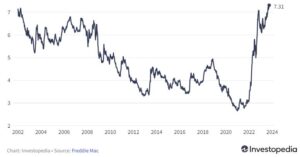

Mortgage rates surged to a new high this week, with the average rate on Freddie Mac's 30-year fixed-rate mortgage at 7.31%—the highest since 2000.1

KEY TAKEAWAYS

- The average rate on a 30-year fixed mortgage guaranteed by Freddie Mac rose to 7.31%—the highest since December 2000, Freddie Mac said Thursday.

- The Fed's rate hikes have caused borrowing costs on a variety of consumer loans to spike.

- Rising mortgage rates could make borrowing money for a house even more expensive for consumers at a time when affordability is at multi-decade lows.

It's the result of a series of rate hikes by the Federal Reserve since early last year in an effort to tame inflation. Rising interest rates have pushed borrowing costs higher for all kinds of consumer loans, from mortgages to car loans and credit cards. The average rate on 30-year mortgages has roughly doubled since the start of 2022 when it stood at about 3%.

30-Year Fixed Mortgage Hit 23-Year High, Says Freddie Mac

Rising mortgage rates make borrowing money for a house even more expensive for consumers at a time when affordability is at multi-decade lows.

While rising mortgage rates directly impact demand, they could also exacerbate the inventory shortage as homeowners who locked in lower mortgage rates earlier in the pandemic become increasingly reluctant to sell.

As a result, home prices could stay elevated despite the pullback in demand.

Source: investopedia.com

#humanitiesinrealestate